Using a cap rate when evaluating a house hack can make it a lot less intimidating. The cap rate can give you a quick way to easily compare multiple properties in your target market.

By understanding how a house hack’s cap rate can help predict your return, you will be able to make sure the value is worth your investment. This can potentially save a rookie investor thousands of dollars when they’re first house hacking.

However, like many new real estate investors, you may be asking yourself, what is cap rate?

In this post, I will teach you 5 things you must know about cap rates.

What is a cap rate?

The cap rate (shortened from capitalization rate) is used when evaluating multiple different properties in the same target market to see which one will yield a higher return for the amount of risk you are taking.

The cap rate is also your unleveraged return, or how much you would earn from a property if you had no debt on it — meaning you purchased it with all cash.

By using the cap rate, you can make sure that a property’s price and annual income will give you the return you are hoping for based on your risk tolerance. With this simple and quick calculation, you can quickly determine whether or not you should analyze a property further.

How to calculate cap rate?

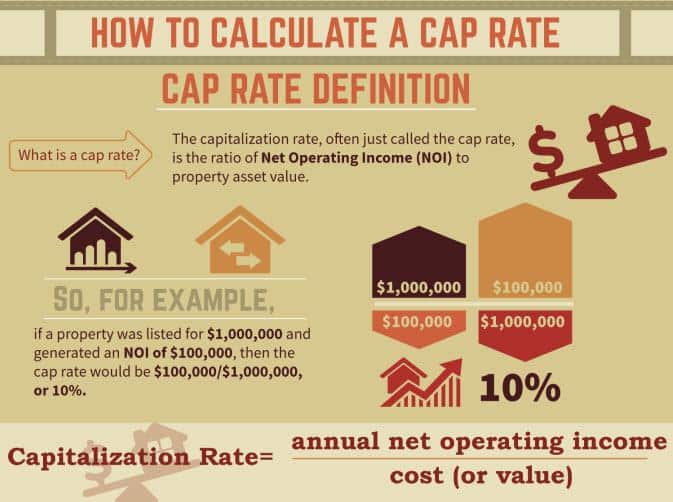

To calculate the cap rate, you take the net operating income of a property and divide it by the cost of the property (or the amount you are willing to offer).

Net operating income (NOI) is the amount of rent you collect annually from a property minus all of your operating expenses, not including any debt servicing (debt payments). These operating expenses can include property management fees, taxes, cost of repairs, vacancy, and more.

Cap rate formula

NOI / property price = cap rate

Cap rate example

The property’s purchase price for a duplex is $400,000. The monthly rent you collect from the half of the duplex you rent out is $1,600.

You will take the monthly rent ($1,600) and subtract the expenses for the property, not including any debt payments.

For this duplex example, assume the monthly expenses are $400 a month.

That makes the net operating income (NOI) $1,200 ($1,600 – $400).

You then take the $1,200 and multiply it by 12 to get the annual net operating income (NOI), which is $14,400.

Finally, you take the annual net operating income (NOI) of $14,400 and divide it by the purchase price of $400,000.

This gives you a cap rate of 3.6% for this duplex.

You can use this formula to compare the cap rate of multiple deals with similar characteristics to see which one could yield you a higher return.

Also, keep in mind, that this is when utilizing this duplex as a house hack. The cap rate on a house hack basis can be helpful when comparing multiple house hacking opportunities, but it cannot be compared to a traditional rental.

To determine the cap rate of a traditional rental for the duplex in the example above, simply multiply all the income and expense numbers by 2 to get the total amounts for a duplex (since there are two units).

When should you use it to evaluate a deal?

You can use a cap rate as part of your analysis for most real estate deals.

You’ll notice that this is very common lingo amongst real estate experts.

When using the cap rate to evaluate a property, it is important to find properties with similar characteristics — similar area, amenities, occupancy rates, etc.

The more time you take to ensure the properties have similar real estate features, the more beneficial the cap rate comparison will be.

For example, if you are attempting to acquire a property that has full occupancy, make sure you are comparing it to other properties that also have full occupancy.

What is a good cap rate?

Well, first, “good” is a relative term.

But, we can evaluate cap rates on a spectrum based on what good means to you.

Maybe you are an investor looking for a higher rate of return and willing to take on more risk. A cap rate between 8-10% might be what you are searching for in your next deal.

On the flip side, maybe you are an investor who is looking for a lower return from a safer investment. A cap rate between 2-6% may be better suited for you.

A property that is well maintained, has appropriate rental prices, a solid property manager, lower taxes, and other well-managed operating expenses, will generally yield a lower cap rate.

A good cap rate is also very heavily dependent on the area. A good cap rate in the midwest United States is going to be very different than downtown New York City or Los Angeles.

When should you avoid using it?

You should avoid using a cap rate, or at least, it won’t be very helpful, when you are looking for a short-term investment.

For example, if you are flipping a property and not partaking in a buy-and-hold strategy or house hacking, using the cap rate will not allow you to accurately depict the return or profitability of your investment.

Frequently Asked Questions About Cap Rate

A good cap rate is highly subjective and dependent on your investing goals, but many investors consider a good cap rate to be between 5% and 10%.

A 7.5% cap rate means that you can expect 7.5% of the property’s purchase price as annual net operating income.

A simple explanation for cap rate is that it is showing how much cash a property produces before paying for its mortgage as a percentage of the purchase price.

If all else is equal, it is better for a cap rate to be higher than lower because you’re earning more income as a percentage of your purchase price. However, things are rarely equal across deals, therefore a higher cap rate may not always be better.

An 8% cap rate means that you can expect 8% of the property’s purchase price as annual net operating income.

The cap rate is your unleveraged return, or how much you would earn from a property if you had no debt on it — meaning you purchased it with all cash. Said another way, it is also showing how much net operating income you’d earn as a percentage of the purchase price.

Generally, yes, you’d like for the cap rate to be higher than the interest rate. If it is not, you’re relying on appreciation to make the deal a good one.

The cap rate is not the same as ROI. They are both return metrics when analyzing a real estate deal, but they are different.

To calculate the cap rate, you take the net operating income of a property and divide it by the cost of the property (or the amount you are willing to offer). The cap rate formula is NOI / property price = cap rate

The cap rate formula is: NOI / property price = cap rate

A high cap rate is not necessarily bad, but it can indicate a higher level of risk than a property with a lower cap rate.

Cap rates generally rise with interest rates because property values decrease as interest rates rise.

There are numerous factors that can cause cap rates to rise, including rising interest rates, higher expenses, lower rental income, a worsening location, and declining property value.

Cap rate is an annual return metric in real estate.

A 10% cap rate means that you can expect 10% of the property’s purchase price as annual net operating income.

There are many things that can affect cap rates, including a change in the property’s expenses or rental income, the worsening of the property’s location, interest rates, and the property’s value.

Yes, the cap rate includes taxes. The only expenses not included in the cap rate are your principle, interest, and CAPEX items.