In the investing world, there is a commonly accepted expression that says, “more risk, more reward.” This means that if you’re taking more risk, you should be compensated with a higher reward for taking that additional risk.

If you’re putting $100 at risk and someone else is putting $1,000,000 at risk, who theoretically, all else equal, should earn more reward?

The person who risked $1,000,000.

Or what if someone makes a riskier investment?

Academic theory tells us they should receive a higher rate of return from that investment than someone who makes a less risky investment.

I give you this quick lesson on risk and reward because it relates to a concept I’ve coined about house hacking — comfort versus profitability.

But before we get into comfort versus profitability, let’s quickly review what the house hacking strategy is.

What is house hacking?

House hacking is simply a real estate investing strategy where you purchase a property with the intent of renting out portions of your unused space to reduce your personal living cost. This can take form in many different ways, but the three most common house hacking strategies are:

- Single-Family Home

House hacking a single-family home is purchasing a property with more bedrooms than you need and renting out the additional bedrooms. An example of this strategy would be to purchase a 3-bedroom single-family home, live in one of the bedrooms, and rent out the other two. - Multifamily Property

House hacking a multifamily property is purchasing a piece of real estate with more than one unit, living in one of the units, and renting out the additional units. An example of this is house hacking a duplex, where you purchase a 2-unit property, live in one of the units, and rent out the second unit to a tenant. - Live-In-Flip

A live-in-flip is the least common of these three strategies, but it can still be effective and is fairly common. With a live-in-flip, you choose to live in a bit of a construction zone by combining flipping and house hacking. This strategy requires you to purchase a property that is a bit rundown, fix it up while you live there, then sell the property (or rent it out) when you’re done with it.

Now that you have an understanding of what house hacking is, let’s get back to risk, reward, comfort, and profitability.

Financial Impact of the Various House Hacking Strategies

Think of comfort like the amount of money the person was risking in the previous example, and profitability as the reward.

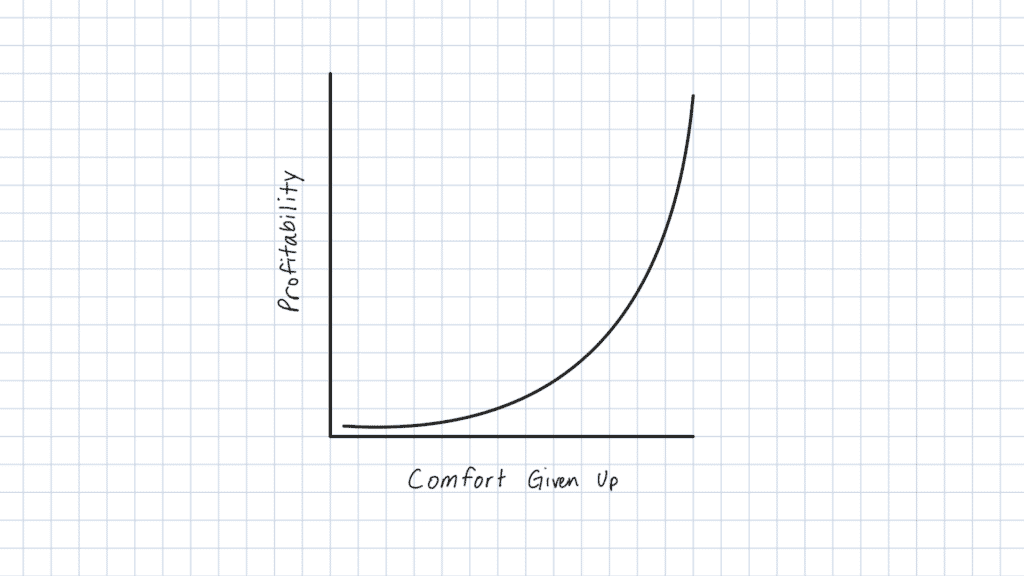

The same relationship that exists between risk and reward also exists with comfort given up and profitability when using a house hacking strategy.

As you can see in the graph above, the more comfort you give up, the more profitable your house hack is likely to be.

If the single-family home house hacking strategy was plotted on the graph above you would see it toward the top right of the graph.

You have to give up the most comfort of any house hacking strategy since you are living

with roommates and sharing a bathroom, kitchen, and other common areas, but it is also one of the most profitable strategies.

Let’s look at an example of how a single-family home house hack’s profit may be different than other strategies.

Multifamily Property

You could go the multifamily house hacking route and purchase a two-bedroom, one-bathroom duplex for $350,000, with a total monthly payment of $2,000, including principal, interest, taxes, insurance, and PMI.

You rent out one of the units for $1,300, and you live in the other unit. Many house hackers would consider that a great success — rather than renting and paying the market rent of $1,300 per month, you can cut that nearly in half and live for only $700 per month!

That would give you an extra $600 per month to save, invest, or spend, all while not having to sacrifice much comfort. Some house hack duplexes are really nice, and similar to traditional homeownership.

Single-Family Home

Instead of going the multifamily route, let’s say you sacrifice a bit more comfort and buy a single-family house hack.

Since you are only buying one house, instead of essentially two with a house hack duplex, you find a four-bedroom, one-and-a-half-bathroom single-family home for $350,000.

This keeps your total monthly payment at $2,000, including principal, interest, taxes, insurance, and PMI.

You rent out three of the bedrooms and live in the remaining one. The market rent in your area for a studio or one-bedroom apartment is between $800 and $950. Since those scenarios allow for the renter to live alone, whereas your house does not, you provide a discount and rent each room for $700 per month.

Using the rent by-the-room strategy, you are bringing in $2,100 in monthly rent ($700 x 3 bedrooms = $2,100). Therefore, you are making $100 in profit over your mortgage payment each month.

Instead of paying hundreds or thousands of dollars each month for rent or a mortgage, you are essentially getting paid to house hack.

The multifamily house hack example is still significantly better than the traditional path of homeownership because you can reduce your expenses by $600 per month while building equity and taking advantage of the house hacking tax benefits.

With multifamily house hacking you are quite far to the left on the comfort given up versus profitability graph because you are not sacrificing much comfort and therefore you are sacrificing some profitability. Whereas the single-family house hacking strategy sacrifices more comfort in order to gain more profit.

Live-In-Flip House Hacking

The live-in flip strategy is interesting when considered on the comfort versus profitability graph.

In the short term, it would be quite far to the left because it requires little sacrifice of comfort and therefore garners little profit. As you move into the long term, you sacrifice a bit more comfort, as you have to live in a construction zone for a time, but you also gain significant profits from the forced appreciation.