If house hacking were a sport, house hacking with a VA loan would be the MVP.

If you are, or were, in the military and able to use a VA loan for house hacking, consider yourself winning the championship game!

You have an opportunity to build wealth that not everyone has, and trust me it’s a good one.

House hacking with a VA loan could be your ticket to not only having your mortgage and housing expenses offset (or even completely paid by someone else), but also the opportunity to create passive income and even possibly retire early.

And, you could qualify to do this with zero dollars down!

Sounds like a win, win right?

If you have a military affiliation and are looking for one of the most affordable ways to house hack, I highly encourage you to explore this option.

Let’s dive in and break it all down to see if house hacking with a VA loan can help you reach your investment goals.

What is house hacking?

House hacking is a creative (another word for genius!) real estate investing strategy where you purchase or use your existing single-family or multifamily property, live in one room or unit, and rent out the others. Typically, the income from your tenants is used to pay the mortgage and offset your housing expenses. If investing in real estate and saving money while living for free sounds good, then let’s get to the meat and potatoes of the house hacking strategy.

Why house hacking?

House hacking can be a great strategy to get you started and exposed to real estate investing — it’s like learning with training wheels, or landlording “light.”

Since you will be living in the property and using it as your primary residence, you will most likely be offered lower interest rates than if it were strictly an investment property. You will also have the option to finance with smaller down payments using a VA loan. More on that later!

But wait, there’s more!

Here are 6 additional ways to make money investing in real estate by house hacking with a VA loan:

- Cash flow (or at least reduction in expenses)

- Building equity

- Market appreciation

- Loan paydown

- Tax benefits

- Inflation hedge

How To: House Hacking With A VA Loan

First things first, you will want to determine if house hacking is for you. If you are still searching for more in-depth and detailed information after reading this article, I highly recommend checking out The Everything Guild to House Hacking.

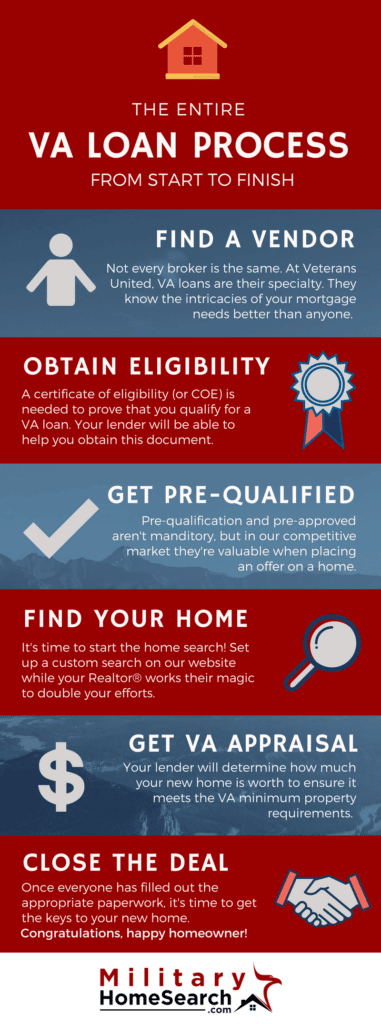

Once you commit to this powerful strategy, you will want to determine your eligibility and get pre-approved by a lender (there are lenders that specialize in VA loans).

The next steps involve researching and determining a property type, market, and location for your house hack, networking and building a team, and then onto of the most important aspects, which is running your numbers.

You can learn the exact process of analyzing a house hack deal using our free house hacking calculator.

Benefits of House Hacking With A VA Loan

By far the biggest benefit to house hacking with a VA loan is that you are potentially able to put no money down.

Yes, you heard that right, no money upfront, and 100% financing!

Another VA loan benefit is no personal mortgage insurance, known as PMI, is required which can add up to some pretty big savings over other owner-occupied loans.

VA loans generally also have lower interest rates and are more flexible with debt-to-income (DTI) and lower credit scores than traditional mortgage products.

Why don’t all eligible VA and Military members do this?

House hacking with a VA loan is indeed a powerful strategy.

However, it’s not all rainbows, butterflies, and ponies.

The VA loan only works for primary residences, not investments, so you have to be okay living in the property for at least a year (aka, house hacking).

There may be the potential for obstacles, such as finding a deal, obtaining the mortgage, and managing and living near your tenants, which some people are not okay with.

You may also have to sacrifice things, such as location, neighborhood, and property type, which, again, people don’t often like sacrificing.

Final Thoughts

Considering everything mentioned above, if you are eligible, then house hacking with a VA loan is a fantastic and affordable option to get your feet wet or accelerate your real estate investing journey.

As our founder, Robert Leonard, likes to say, house hacking is a wealth-building supercharger.

You can skip the saving for a down payment part, cruise past Go, and collect $200. Oh, wait, wrong game!

Or is it? Instead of playing pretend Monopoly, you’re starting to do it in real life.

But seriously, house hacking with that VA loan helps you acquire knowledge, experience, accumulate wealth, and turns a liability into an asset — that’s a slam dunk!

Frequently Asked Questions About House Hacking With A VA Loan

Yes, you can house hack with a VA loan.

You cannot use a VA loan for an investment property, unless you are house hacking.

You cannot use a VA loan to purchase a property solely for use on Airbnb. However, if you are house hacking with a VA loan, you can include Airbnb.

Yes, the VA allows 2 unit properties as long as you are living in one of the units.

Yes, you can buy a 4 unit with a VA loan as long as you are living in one of the units.