You’ve probably landed here because you’re wondering if you can use a VA loan for investment property, or a VA loan for rental property, right?

In this post, we’re going to answer exactly those questions.

Can you use a VA loan for an investment property?

Based on the eligibility criteria for VA loans, you cannot use one for a traditional investment or rental property.

However, once you better understand VA loans, you can learn how to work around these criteria. Then you can use a VA loan for house hacking, which can get you a rental property from a VA loan.

VA Loan for Investment Property: What You Need to Know Before Applying

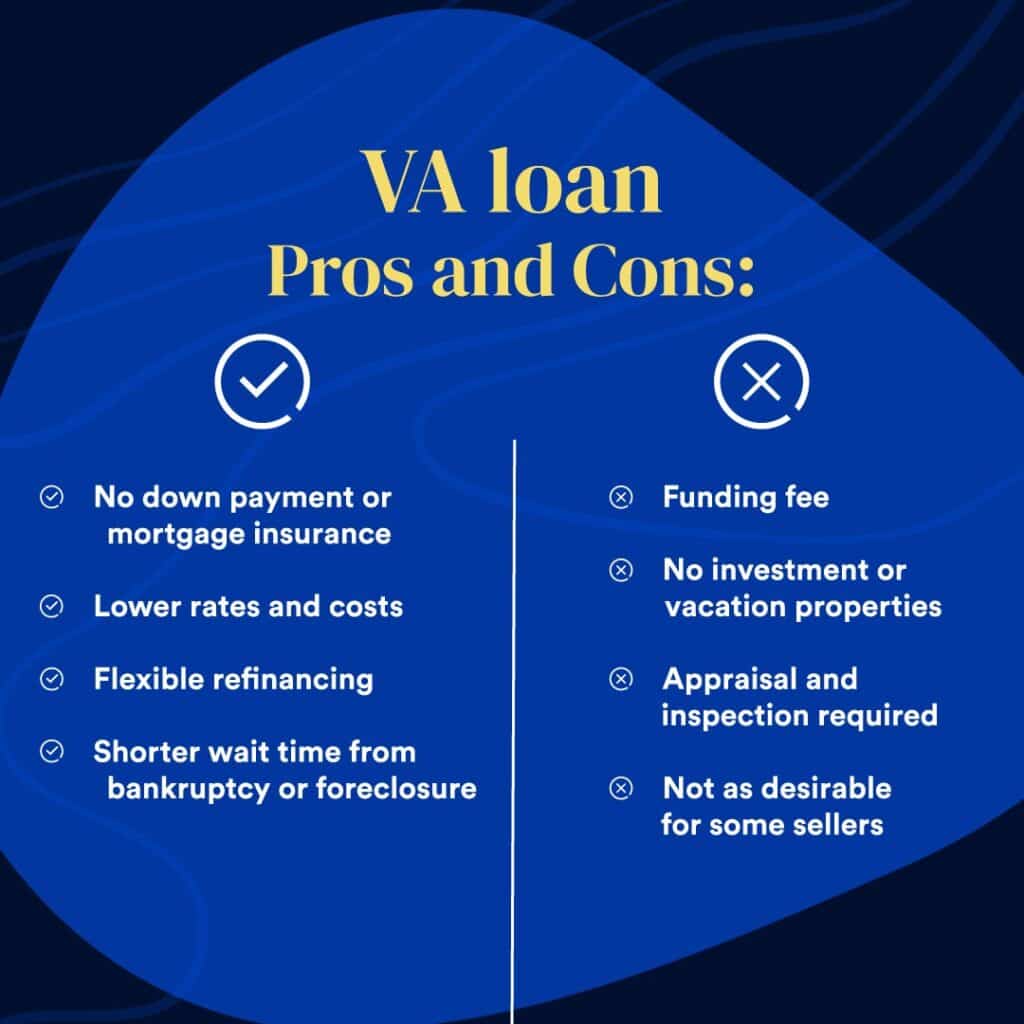

VA loans allow eligible applicants to apply for a home loan without a down payment, mortgage insurance, and generally have more lenient credit requirements.

In terms of the application and approval process, they’re similar to other home loan programs. You need to fill out an application, show that you can repay the loan using your income and credit history, and have enough savings to cover the closing costs.

Who can apply for a VA loan?

To get a VA direct or VA-backed loan, you’ll need to check off a couple of eligibility requirements. You’ll need to acquire a Certificate of Eligibility (COE) to prove to the lender that your service history and duty status make you eligible for a VA loan.

Certificates of Eligibility are issued to active service members and veterans. The first condition is that you didn’t receive a dishonorable discharge. Next, you’ll need to check whether you meet the minimum active-duty service requirements.

Service members need to have served for at least 90 days without a break in service to meet the minimum active-duty service requirements. For veterans, national guard members, and reserve members, the minimum active-duty service requirements vary based on the period in which you served.

Applicants discharged because of hardship, government convenience, reduction in force, medical conditions, or a service-connected disability may still qualify for a COE. The surviving spouses of veterans or veterans who are missing in action or being held as prisoners of war may also qualify for a COE.

If you’re interested in a VA-backed home loan, you’ll also need to meet the lender’s credit and income requirements to get financing.

Primary residence as an eligibility criterion

With a VA loan, the borrower must occupy the property as a primary residence. That means you won’t be able to purchase the property and rent it out without making it your primary home. However, it doesn’t mean you cannot rent out a separate rental unit, room, or detached apartment on the lot.

How to Use a VA Loan for an Investment or Rental Property?

VA loans cannot be used directly to purchase an investment property or a rental. Instead, you can find ways to use them for house hacking, which you can then later turn into a rental property.

Since most VA loans simply require that you live in the property for 12 months, you can house hack for 12 months, then move out and rent the property as a traditional rental from there on out. Now you used a VA loan for investment property.

You can analyze a house hack deal to determine if it’d be a good rental using our free house hacking calculator.

VA Home Loan Types

VA loans are provided by private lenders, with the VA guaranteeing a portion of the loan. You can use a VA loan to purchase an existing house, build a new one, make home improvements, or refinance an existing home loan. With the VA loan program, you can get two types of loans: VA direct and VA-backed home loans.

VA direct home loans

A VA direct home loan is a financing option where the U.S. Department of Veterans Affairs serves as the mortgage lender. With a VA direct loan, you will work directly with the VA throughout the entire lending process. The department features a Native American Direct Loan program which is often a much better alternative than home loans from private lenders.

Native American veterans and their spouses may be eligible for a NADL loan if they meet the following requirements:

- Have a valid VA home loan Certificate of Eligibility

- Meet the U.S. Department of VA’s credit standards

- Have a steady income that’ll allow you to cover mortgage payments and other costs

- Live in the home subject to the NADL

- Your tribal government has an agreement or a Memorandum of Understanding with the U.S. Department of VA

In most cases, a NADL doesn’t require a down payment. You won’t need private mortgage insurance either. The closing costs are limited, and the interest rates are quite low, with a fixed mortgage guaranteeing that the interest rate won’t change during the life of the loan.

VA-backed home loans

A VA-backed home loan is a home loan acquired from a conventional private lender, with the U.S. Department of VA standing behind a portion of the loan. With the guarantee provided by the VA, the lender can recover some of their losses if the loan goes into foreclosure.

VA-backed home loans pose a lower risk to the lender, so you’ll likely get better terms and faster approval. Although some VA-backed loans still require a down payment, around 90% of VA-backed home loans are made without a down payment.

The lender and borrower must follow the VA standards for a VA-backed loan. However, despite the initial requirements and conditions posed by the VA, the private lender may have some additional standards and requirements. Most of the time, the additional criteria refer to credit score and your ability to repay the debt.

Conclusion

Although using a VA loan for rental property isn’t as straightforward as using a traditional investment loan, or getting a conventional home loan, it is quite a cost-effective solution that you can make work in multiple ways if you’re willing to get creative.

If you’re interested in learning more about house hacking, check out our book The Everything Guide to House Hacking.

Frequently Asked Questions About Using A VA Loan for Investment Property

You cannot use your VA loan for investment property only. However, if you’re house hacking, you can.

The short answer is no, you can’t use your VA loan to buy a rental. However, you can use your VA loan to house hack, which can get you a rental property.

In most cases, yes, you can rent out your VA loan home after 1 year. Most VA loans require you to live in the property for at least 12 months, but then you can move out and rent it.

You have to occupy a VA loan home for 12 months in most cases, unless you meet the criteria for exception. After 12 months, you are able to move and rent it out if you’d like.

Technically, is it possible? Yes, it is possible. Should you do it? No, you should not rent out your house without telling your mortgage lender. That is considered mortgage fraud, which has serious consequences.